Crypto in the Mainstream: Analyzing the Adoption Curve

The trajectory of cryptocurrency adoption is a dynamic journey, with digital assets transitioning from niche interests to mainstream acceptance. In this insightful analysis, we delve into the adoption curve of cryptocurrencies, examining the factors influencing widespread acceptance, the challenges faced, and the transformative impact on traditional financial systems.

Understanding the Phases of Adoption

1. Early Adopters:

- Explore the role of early adopters in laying the foundation for crypto adoption.

- Discuss the enthusiasts and innovators who embraced digital assets in their infancy.

2. Growth and Expansion:

- Examine the factors contributing to the growth of cryptocurrency usage.

- Discuss how increased awareness, technological advancements, and market maturation fueled expansion.

3. Mainstream Acceptance:

- Analyze the pivotal moments that propelled cryptocurrencies into the mainstream.

- Discuss the influence of institutional adoption, regulatory developments, and global recognition.

Factors Influencing Adoption

1. Institutional Participation:

- Evaluate the impact of institutional players entering the crypto space.

- Discuss how the involvement of major financial institutions has influenced market dynamics and perceptions.

2. Regulatory Clarity:

- Explore the role of regulatory clarity in fostering mainstream adoption.

- Discuss how clear regulations contribute to investor confidence and institutional engagement.

3. Technological Advancements:

- Assess the significance of technological advancements in cryptocurrency infrastructure.

- Discuss how improvements in scalability, security, and user experience drive adoption.

Challenges on the Path to Mainstream Adoption

1. Volatility Concerns:

- Address the persistent challenge of price volatility in the crypto market.

- Discuss how volatility impacts user trust and wider adoption.

2. Education and Awareness:

- Explore the importance of education in overcoming barriers to entry.

- Discuss initiatives aimed at increasing awareness and understanding of cryptocurrencies.

3. User-Friendly Interfaces:

- Assess the role of user-friendly interfaces in enhancing adoption.

- Discuss the importance of accessible platforms and intuitive applications.

Transformative Impact on Financial Systems

1. Decentralization and Financial Inclusion:

- Discuss how cryptocurrencies contribute to financial inclusion.

- Explore the role of decentralized finance (DeFi) in providing services to the unbanked and underbanked.

2. Cross-Border Transactions:

- Analyze the impact of cryptocurrencies on cross-border transactions.

- Discuss how digital assets streamline international payments and reduce friction.

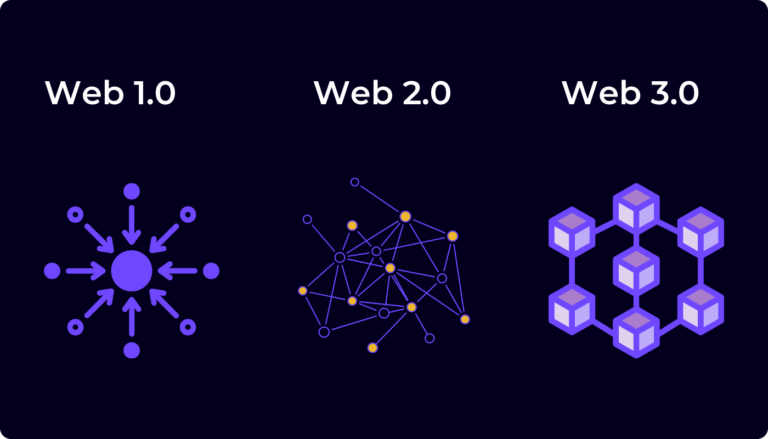

3. Shifting Paradigms:

- Explore how crypto adoption challenges traditional financial paradigms.

- Discuss the potential for cryptocurrencies to reshape banking, investment, and wealth management.

The Future of Crypto Adoption

1. Evolving Use Cases:

- Explore emerging use cases beyond speculative trading.

- Discuss the role of non-fungible tokens (NFTs), decentralized applications (DApps), and blockchain technology in various industries.

2. Global Integration:

- Discuss the trajectory of crypto adoption on a global scale.

- Explore how different regions are embracing digital assets and blockchain solutions.

3. Regulatory Developments:

- Address the ongoing impact of regulatory developments on crypto adoption.

- Discuss how regulatory frameworks shape the future landscape of digital assets.

Conclusion: Navigating the Mainstream Crypto Landscape

As cryptocurrencies traverse the adoption curve, their transformative impact on the financial landscape becomes increasingly evident. From the early enthusiasts to institutional investors, each phase contributes to the evolution of digital assets into a mainstream financial instrument. This analysis navigates the complexities of crypto adoption, offering insights into the challenges, influencers, and future possibilities of a world where cryptocurrencies are not just accepted but integrated into the fabric of our financial systems.