INDEXDJX DJI – A Complete Guide!

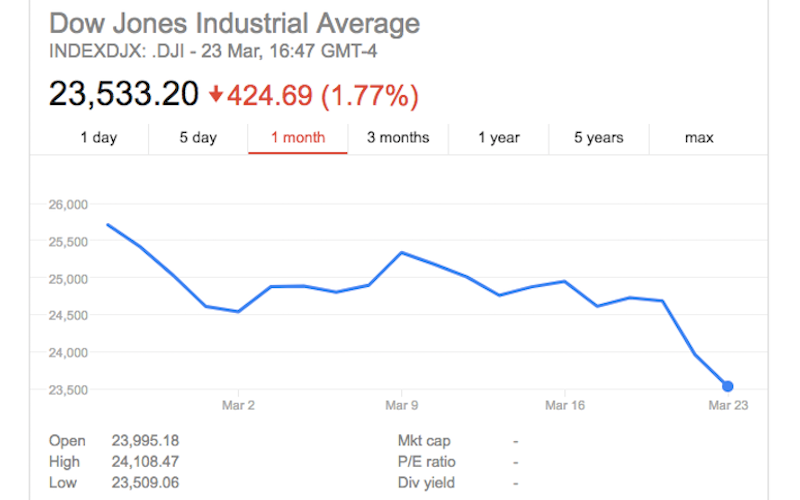

The INDEXDJX DJI, commonly known as the Dow Jones Industrial Average (DJIA), remains an influential financial barometer, offering a snapshot of the stock market’s health. It symbolizes the performance of major companies and impacts global economic sentiments.

INDEXDJX DJI, or the Dow Jones Industrial Average (DJIA), is a vital stock market index representing the performance of 30 significant companies, reflecting the market’s overall health.

This article will explore the significance, history, components, and FAQs related to INDEXDJX DJI. We’ll explore its role in the financial landscape and why it remains a benchmark for investors worldwide.

Table of Contents:

What is INDEXDJX DJI – You Must Know!

INDEXDJX DJI refers to the Dow Jones Industrial Average (DJIA), commonly known as “the Dow.” A stock market index tracks the performance of 30 large, publicly-owned companies traded on the New York Stock Exchange (NYSE) and the NASDAQ.

Created by Charles Dow in 1896, the DJIA is one of the oldest and most widely followed stock market indices globally.

It is used as a barometer to gauge the overall health and direction of the U.S. stock market and economy due to the inclusion of well-established and influential companies across various industries such as technology, healthcare, finance, and more.

The DJIA is a price-weighted index, meaning that the stocks included in the index are weighted based on their prices rather than their market capitalizations. This means that higher-priced stocks have a more significant impact on the index’s movements.

The index is calculated by adding the stock prices of its 30 components and dividing the total by a divisor that accounts for stock splits, dividends, and other adjustments to ensure continuity in the index’s value over time.

As a widely followed indicator, movements in the DJIA often attract considerable attention from investors, analysts, and the media as an indicator of the overall stock market performance in the United States.

Read Also: TTU Blackboard – Your Path to More Accessible Learning!

The Legacy Of INDEXDJX DJI – Let’s Explore!

The INDEXDJX DJI is among the world’s oldest and most widely recognized stock market indices. Originating in 1896 by Charles Dow and Edward Jones, it comprised just 12 companies. Today, it encompasses 30 significant corporations across various sectors, reflecting the market’s dynamics.

The index acts as a reliable indicator, gauging the performance of companies from diverse industries influencing investment decisions and market sentiments globally.

The INDEXDJX DJI has weathered numerous economic fluctuations, serving as a resilient measure of the market’s stability and growth potential.

Components And Methodology Of INDEXDJX DJI – Dive In It!

The INDEXDJX DJI comprises blue-chip companies representing technology, finance, healthcare, and more sectors. Some of its constituents include renowned entities like Apple, Microsoft, and Coca-Cola.

The index is a price-weighted average, where higher-priced stocks carry more significance in calculating the average. Despite criticisms for its methodological limitations compared to the market-cap-weighted index, the DJIA remains a trusted investor benchmark.

Read Also: Jobdirecto – Your Gateway To Job Success!

Impact On Global Financial Markets – Uncover The Truth!

The performance of the INDEXDJX DJI exerts a significant influence on global financial markets. Changes in its value often result in market reactions and affect investor confidence worldwide.

Analysts and economists closely monitor the index’s movements to gauge market trends and make informed decisions. Investors use the DJIA as a benchmark to assess their portfolio performance, comparing their returns against the index’s growth or decline.

Read Also: Auractive – Transform Your Life with Positive Energy!

Short Conclusion:

INDEXDJX DJI, the Dow Jones Industrial Average, is a vital indicator reflecting market health, guiding investment decisions, and influencing economic sentiments worldwide.

It remains an influential financial barometer, offering a snapshot of the stock market’s health.

FAQs:

1. What is the significance of the DJIA for investors?

The DJIA is a crucial investor benchmark, offering insights into the market’s health and influencing investment decisions.

2. How often are the components of the DJIA updated?

Changes in the DJIA components are infrequent, typically due to mergers, acquisitions, or drastic changes affecting existing companies.

3. Is the DJIA the best indicator of market performance?

While widely recognized, some argue that other indices like the S&P 500 or NASDAQ provide a more comprehensive view due to their methodology.

4. How does the DJIA impact the global economy?

Fluctuations in the DJIA often influence investor sentiment worldwide, impacting stock markets and economic policies.

5. Can individual investors invest directly in the DJIA?

No, the DJIA is an index, but investors can invest in exchange-traded funds (ETFs) or mutual funds, mirroring its performance.